|

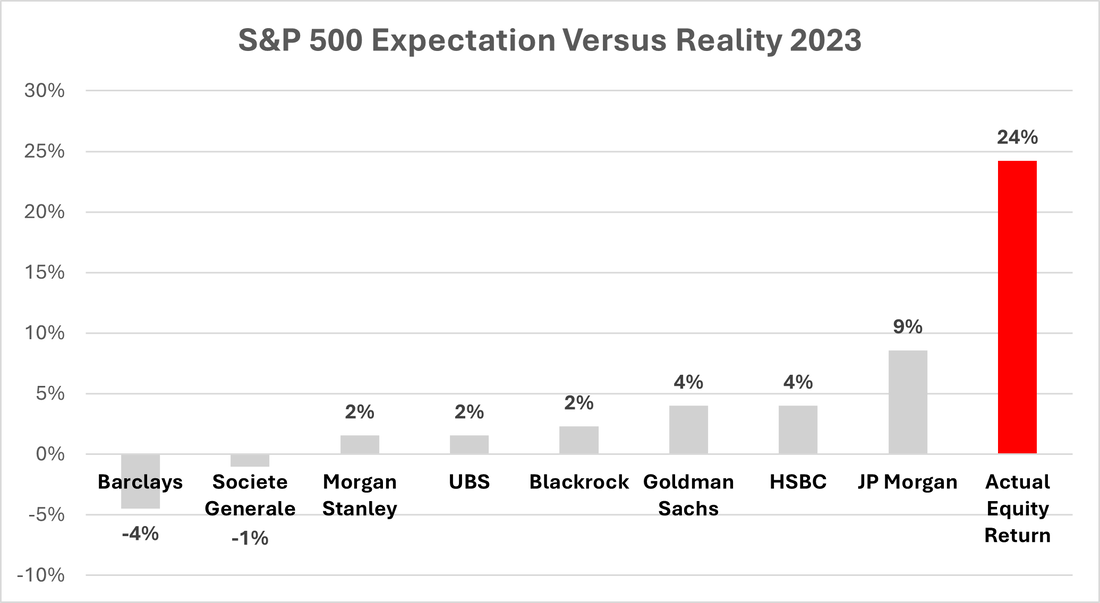

At the start of each year, most of the main private banks and investment managers issue glossy reports with countless pages and graphs outlining their expectations for investment markets for the coming year. These expectations can vary widely depending on the analysts view of the world. Some of these predications can go spectacularly wrong. One good example of this is when in 2016, RBS wrote to their clients to warn them that they faced a “cataclysmic year” and to move all of their portfolio to cash and high quality bonds. “This is about return of capital, not return on capital. In a crowded hall, exit doors are small.” RBS 2016 After RBS issued this stark warning to their clients, the global stock market[1] increased by 18% in 2016, and from January 2016 to the end of 2023 it has increased by over 140%. In 2023, after an initial expectation of economic weakness and widespread predictions of recession, the global economy showed surprising resilience. Global stocks increased by over 20% for the year. If we go back 12 months and review the various S&P 500[2] market expectations that were issued by the main financial institutions in early 2023, we can see Barclays was the most pessimistic, expecting a return of -4%, while JP Morgan was the most optimistic predicting a return of +9%. Despite the ongoing war in Ukraine, rampant inflation, banking turmoil (that led to the collapse of Silicon Valley Bank and Credit Suisse) and the war in the Middle East, the S&P 500 index delivered a return of 24%, far exceeding all expectations. Predicting what will happen to investment markets over short periods can be very difficult, even for the largest companies with the most significant resources and armies of analysts. The current general consensus for 2024 is that inflation is being brought under control and we should start to see interest rates cuts from the second half of the year. As we have seen before though, we should always expect the unexpected. As your adviser we understand this fact and that is why we always build a financial plan for our clients that is prepared for all eventualities. Only then do we recommending an investment strategy that is based on long term academic research and not short term market predictions. [1] As measured by the MSCI World equity index. We use the MSCI World equity Index as a benchmark for global equities as it tracks the performance of large and mid-cap stocks across the largest 23 Developed Market countries in the world. [2] The S&P 500 is a stock index that tracks the share prices of 500 of the largest public companies in the United States. shane mcinerneyShane is a Director of Distinct Wealth Management with nearly 20 years experience advising Families and Institutions in Ireland on financial planning, investments and pensions. He is a Qualified Financial Adviser and a Chartered Tax Adviser. Comments are closed.

|